Your Retirement . . . with Brian and Bob: Here are a few retirement planning mistakes you need to avoid

Not creating a budget and not tracking your spending are two mistakes to avoid

![]()

By Robert Price and Brian Harrigan

Are you ready to start planning and preparing for your retirement? If so, congratulations, you are taking a step in the right direction. The earlier you start planning for your retirement, the better off you will be when the time comes.

Are you ready to start planning and preparing for your retirement? If so, congratulations, you are taking a step in the right direction. The earlier you start planning for your retirement, the better off you will be when the time comes.

The decision to start planning and preparing for retirement is a wise decision. As previously stated, the earlier you start, the better. With that said, the earlier you start planning for retirement the more mistakes you are likely to make, a few of which are outlined below and can cause financial problems and more.

Not creating a budget and not tracking your spending are two mistakes you’ll want to avoid. This often leads to spending more money than you have. You should be saving for retirement, especially about the age of 40, not getting into debt. Never spend money you don’t have and never spend all your money. It is best, but a must when you reach the age of 40, to start paying for all your purchases with cash, checks, or debit cards. Before doing so, however, make sure you have enough money to spend and keeping on saving for retirement.

Another common mistake people make involves not taking health into consideration. Health and the impact it can have on your retirement can work two different ways. For starters, what if you get sick? Can you afford the cost of emergency surgery or long-term medical care? Even if you are healthy now, remember your health can always take a turn for the worse. It is also important to note advancements in medical technology. Many men and women are living longer than they originally planned. You don’t want to run out of money just because you lived longer than expected.

In keeping with your health and well-being, it is important to examine your spouse and vice versa. There is a good chance one of you will live longer than the other and possibly a significantly longer. Make sure you have enough money to retire on your own in the event your spouse passes away. It is also important to recheck all important documents. Make sure your living trust, will, mortgage, and all property deeds are in order and designed to protect the surviving spouse.

In keeping with your health and well-being, it is important to examine your spouse and vice versa. There is a good chance one of you will live longer than the other and possibly a significantly longer. Make sure you have enough money to retire on your own in the event your spouse passes away. It is also important to recheck all important documents. Make sure your living trust, will, mortgage, and all property deeds are in order and designed to protect the surviving spouse.

Relying too much on government assistance, like social security, is a mistake many make. Did you know social security will only pay for a portion of your retirement needs? On average, it only covers about 40 percent of your needs. What plan do you have for the other 60 percent? If you don’t have a plan, develop one. How and when you choose to take this benefit can make a world of difference.

The biggest mistake many make is dipping into their retirement funds before they are ready to retire. This is a huge mistake that can have a negative impact on your finances in the future. You should never take money from your retirement funds unless it is a dire emergency. Use your retirement savings as a last resort.

The biggest mistake many make is dipping into their retirement funds before they are ready to retire. This is a huge mistake that can have a negative impact on your finances in the future. You should never take money from your retirement funds unless it is a dire emergency. Use your retirement savings as a last resort.

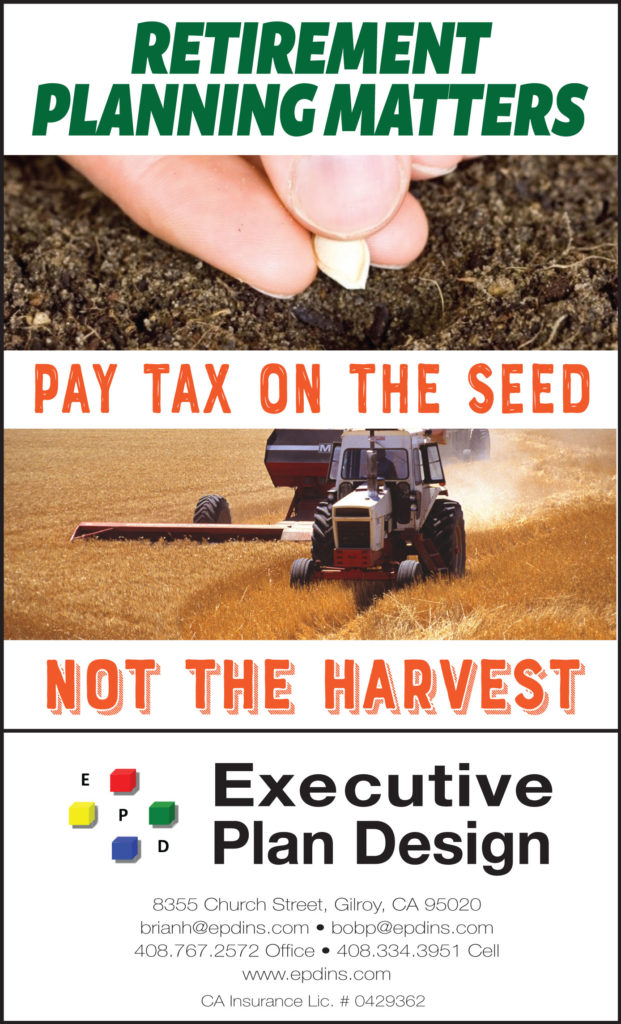

Lastly, not knowing all of your saving options is another mistake you will want to avoid. Did you know there are multiple ways you can save money for retirement? There are, for example, an employer’s 401(k) program, as well as Individual Retirement Accounts (IRAs). These often have a match to contributions and should be taken full advantage of. If you can afford to put away more than the match, you should consider tax advantaged accounts like ROTH IRA’s and Cash Value Life Insurance Spreading out your retirement savings to offer better protection can be the difference between having enough money in retirement or not.