Government: City Council approves public safety funding measure on November ballot

Increase in sales tax needs a ¾ vote to succeed

![]()

By Calvin Nuttall

The Gilroy City Council approved a resolution to place a measure on the ballot for a new 0.25 percent Dedicated Public Safety Special Transactions and Use Tax.

In order to ensure the revenue from the tax is spent solely on public safety and is not added to the general fund, it requires 75 percent approval. The tax would provide between $4.1 and $4.5 million annually to help shore up Gilroy’s critical public safety staffing and infrastructure needs. It would bring Gilroy’s sales tax up to its legal maximum.

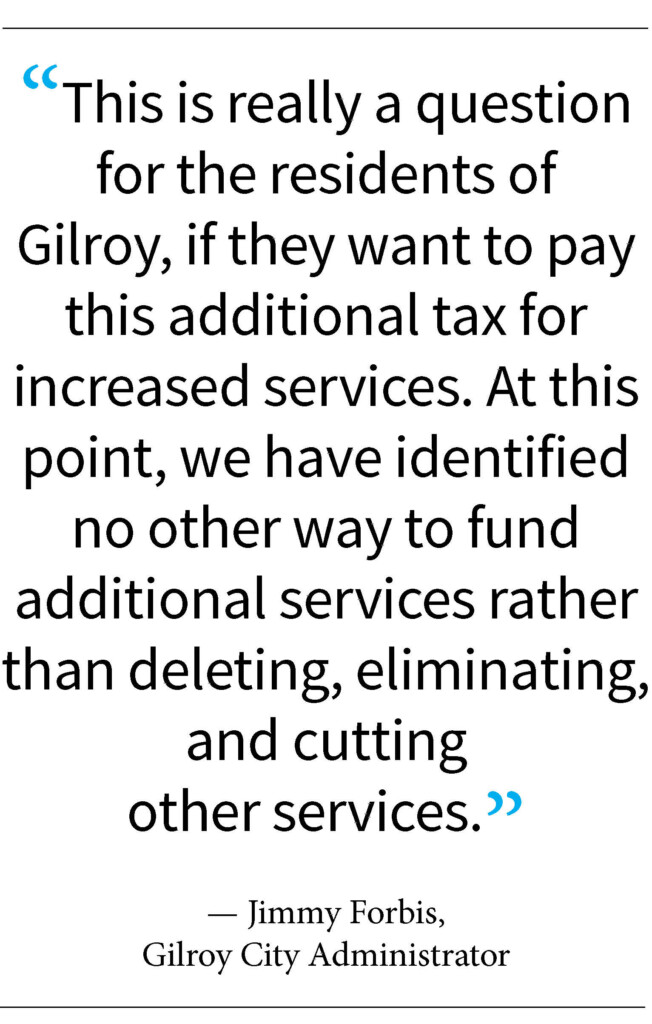

“This is really a question for the residents of Gilroy, if they want to pay this additional tax for increased services,” City Administrator Jimmy Forbis told the council. “At this point, we have identified no other way to fund additional services rather than deleting, eliminating, and cutting other services.”

The tax would not only apply to goods and services in Gilroy but also from other jurisdictions and then delivered in Gilroy, such as purchases made online or out of state.

The tax would not only apply to goods and services in Gilroy but also from other jurisdictions and then delivered in Gilroy, such as purchases made online or out of state.

Forbis stressed to the public the tax is not a perfect solution.

“This is not going to fix everything, but it will do a couple of things,” he said. “We have struggled to fund the third fire station. This will help, this will take care of that. We also know that the city is growing, and we need other services in the area. So, it is going to help with the growth, but it is not the magic wand that fixes everything.”

Gilroy has grappled with a need for additional staffing and infrastructure funding for years, Forbis said. While the special tax would not fully fund the needs staff have identified within the police and fire departments, it would go a long way toward alleviating the city’s growing pains, he said.

“Over the years we’ve seen a large increase in public safety expenditures, and increased calls for services,” he said. “The number of calls has gone up, but it’s more the complexity of the calls. A lot of requirements of our public safety folks are much more complex, and they spend much longer service time on a call than they did many years ago. Plain and simple, we need more people.”

According to analyses by staff, the public safety departments need about 15 more positions in police and 17 more in fire to keep up with present demand. The new tax would provide sufficient funding for about 10 new positions.

“Those are numbers that will just never be realized with our current budget,” Forbis said. “It just will not pan out, even if we were to re-allocate all of our general fund monies away from things like recreation and parks. It still wouldn’t be enough money. You could cut all of those departments and still would find yourself needing more resources to staff a growing city.”

Gilroy attempted in 2014 to implement a sales tax to shore up lagging public safety dollars. Measure F on the ballot would have provided a 0.25 percent increase. When polling showed the special tax would not pass with the 75 percent needed, the city changed it to a general tax requiring a 50 percent vote. Voters did not approve it.

“The only other option we have been made aware of is to go into the city’s reserves,” said Gilroy Police Officers Association President Andrew Lopez in a statement. “However, the city’s reserves are not intended for these purposes. The reserves are there for times of emergency. All we are attempting to do is match the growth of the city, which is why we feel this is the most appropriate option.”

Gilroy Mayor Marie Blankley emphasized the importance of creating a dedicated supply of funding exclusively for public safety as the city continues to grow and build more housing.

“Your property taxes don’t stay here,” she said. “People think we get a much larger chunk of property taxes than we do. Even our sales tax, which is right now 9.125 percent, we don’t get all that. We get one percent of that. This quarter percent would come all to us.”

“Your property taxes don’t stay here,” she said. “People think we get a much larger chunk of property taxes than we do. Even our sales tax, which is right now 9.125 percent, we don’t get all that. We get one percent of that. This quarter percent would come all to us.”

Blankley blames the budget shortfall on the unchecked growth of housing.

“Our population is growing, and none of it comes with more money to pay for city services,” she said. “Housing does not come with money. Yes, there is a little bit of property tax, but we pay it to the county and it goes to the state. Cities get back a little minuscule percentage. That does not pay for our city services, but sales tax does.”

City staff consider the sales tax to be a preferable funding option because its cost burden can be borne partially by visitors rather than wholly by its residents.

“We did include a lot of these provisions we think will help the voters have more confidence,” Forbis said. “There is a proposal for a seven-person citizen’s oversight committee, and annual audits to ensure that funding is spent within the restrictions.”

Calvin Nuttall is a Morgan Hill-based freelance reporter and columnist.